Financial Fact: Digital Wallets — The Future of Fast, Secure, and Convenient Payments

What's in this article:

- What are digital wallets?

- Security features and privacy

- Tips for safe usage

Ever find yourself fumbling through your bag for your wallet and cash while the person in front of you just taps their phone and walks away in a breeze? That’s the magic of a digital wallet, turning a frantic search into a seamless tap-and-go with an otherwise great sense of security.

What Are Digital Wallets?

A digital wallet is software that securely stores your banking information and passwords on your cellphone and electronic devices, allowing for seamless and secure checkouts whether you’re in person or shopping online. Digital wallets can include Apple Pay, Google Pay, PayPal, Cash App, and many more.

Other than your debit and credit cards, digital wallets can also store:

- Gift cards

- Loyalty cards

- Membership cards

- Concert and event tickets

- Airline tickets

- And in some states, a driver’s license

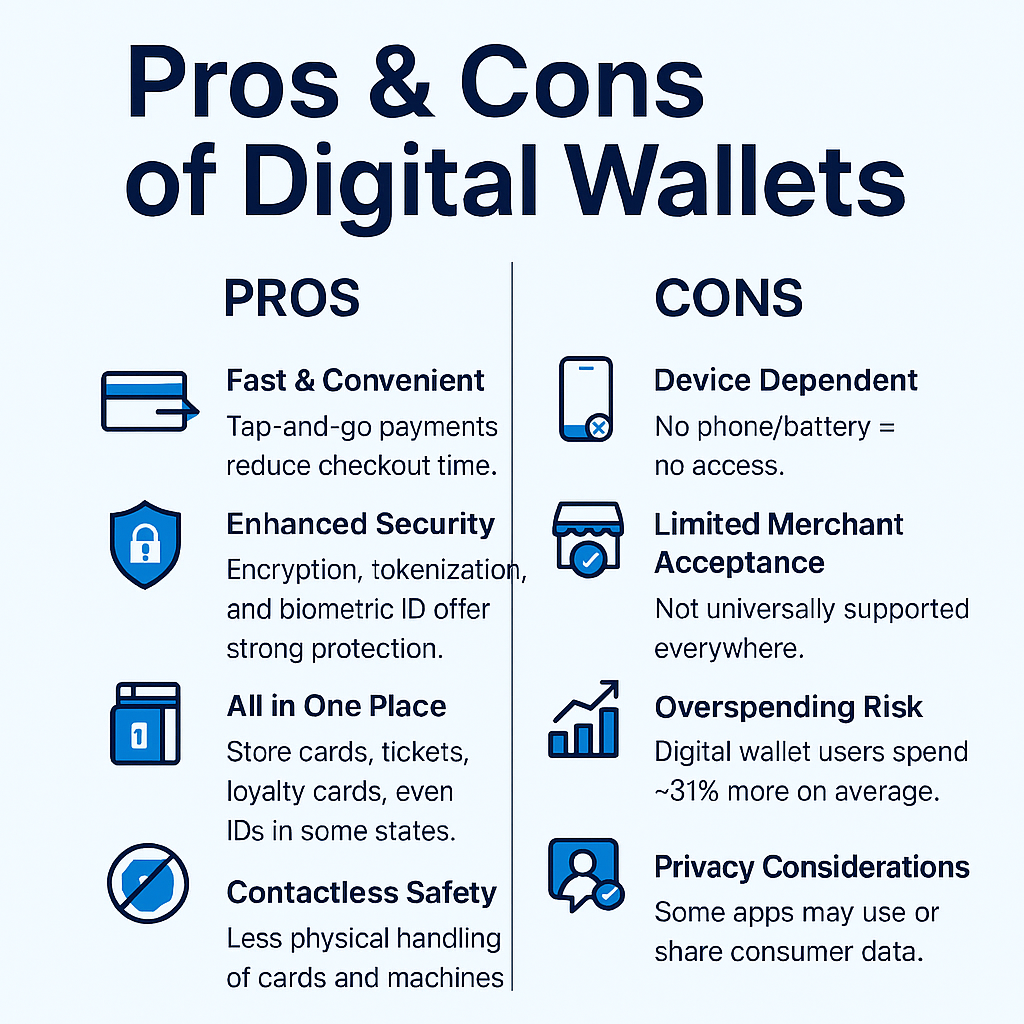

Contactless payments have become a major advantage of using digital wallets. In 2024, 57 percent of U.S. adults used digital wallets and 53 percent of Americans used electronic wallets more frequently than traditional payment methods.¹ This has transformed our daily shopping experience and even our spending habits, with privacy and security being the biggest influencer for the surge in usage. The ease of use and accessibility of simply tapping your phone has been a driver in an increase in consumer spending. In fact, per an Amazon Web Services survey, 2 digital wallet users on average spend 31 percent more than those who use traditional payment methods. Thus, those who use electronic wallets may need to be more cautious about avoiding overspending.

While the convenience of tapping your phone plays a major role, digital wallets are also designed with multiple layers of privacy and protection features that often make them more secure than a physical card.

Security Features & Privacy

Digital wallets offer advanced security features, such as encryption, tokenization and multifactor authentication to protect consumers’ finances and ensure privacy during transactions.

One of the primary features of an electronic wallet is encryption. This is an advanced technology that scrambles personal payment data, making it unreadable to hackers and any unauthorized individuals who might try to intercept it during a transaction.3

In addition to encryption, digital wallets also use tokenization, which is designed to generate a one-time encrypted code or “token” during transactions instead of sharing your actual card number. This feature reduces the risk of fraud if a merchant’s system is compromised.

Another layer of protection comes from multifactor authentication, using technology such as Face ID, fingerprint scanning, and secure one-time passwords. If your phone happens to be lost or stolen, the unauthorized user will not be able to complete a transaction without completing authentication.

Tips on Safe Usage

While digital wallets offer built-in security features, users still play a crucial role in protecting their personal information. A few simple habits can significantly reduce the risk of fraud:

- Always enable multifactor authentication or a strong passcode for digital transactions. Face ID, secure PINs, and other safety features add an extra layer of protection and prevent unauthorized access if your phone is lost or stolen.

- Keeping your device’s software and wallet apps up to date is another important step. Many updates offer enhanced security and bug fixes that protect against new threats.

- Monitor your account activity regularly. Reviewing your transactions frequently allows you to spot unauthorized charges early and report suspicious activity before further damage occurs.

- Avoid using public or unsecured Wi-Fi when accessing digital wallets or making payments, as these networks may expose sensitive information.

Electronic wallets offer a fast, convenient way to pay while reducing the need to carry physical cards or cash. With built-in security features and responsible usage habits, they can be a safe and efficient tool for managing everyday transactions. Understanding how digital wallets work and how to use them safely can help consumers decide whether they fit into their everyday financial routine.

Sources

Digital Wallet Statistics (2025): Users, Growth Rate & Trends1

Consumers spend more with digital wallets2

Are Digital Wallet Transactions Secure? | PayPal US3

The inclusion of references to third parties is purely informational and does not constitute an endorsement by MMBB.

Next

Next

Next

Next