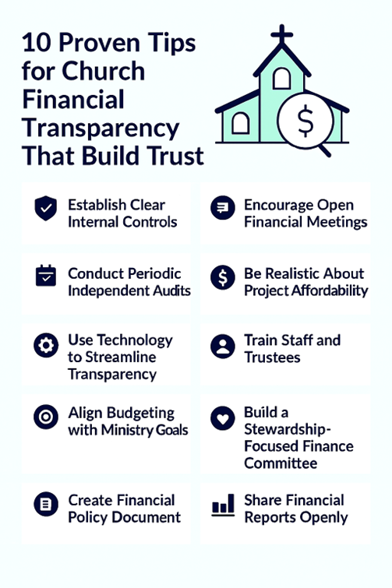

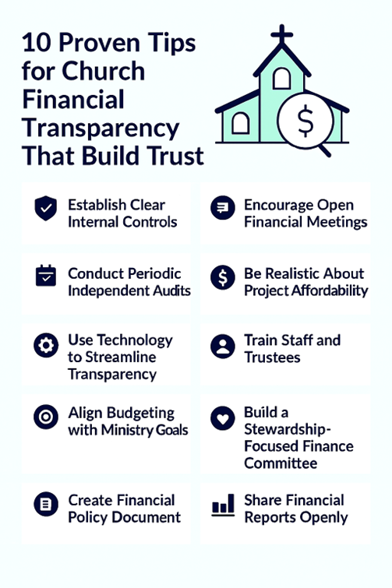

10 Proven Tips for Church Financial Transparency That Build Trust

By Rev. Dr. William H. Foster, Jr., MBA, DMin, MDiv, Director, Marketing & Strategic Relationships

Financial transparency is more than a best practice — it’s a spiritual discipline rooted in stewardship, accountability, and trust. In today’s digital age, congregants expect even greater clarity on how their church uses donations, and they seek assurance that resources are being managed with integrity. Without transparency, churches risk eroding trust, disengaging donors, and undermining their mission.

Transparency builds trust with congregations and enhances generous giving. It’s a vital part of stewardship that reflects the church’s commitment to ethical leadership and faithful resource management. Read on for 10 actionable strategies to enhance your church’s financial transparency.

- Establish Clear Internal Controls

When one person manages all the church’s financial matters, the absence of oversight increases the risk of error or fraud. Separate financial duties to avoid situations where the same person who counts the offerings is also writing checks and reconciling accounts. In smaller churches with limited staff and volunteers, divide responsibilities between at least two individuals or establish a finance oversight committee to conduct regular reviews. Use checklists and protocols to guide these reviews.

-

Conduct Periodic Independent Audits

Engage external professionals for periodic audits or reviews. The findings can reassure stakeholders about your church’s financial integrity and help improve processes and systems. Auditing professionals often offer various service packages at different price points, so you may be able to find an affordable option that meets your needs even if your budget is limited.

-

Use Technology to Streamline Transparency

Digital tools like QuickBooks for Nonprofits, Tithe.ly, and Church Windows, among others, automate workflows, budgeting, donor management, payroll or reporting. These platforms offer secure dashboards, donor analytics and cloud computing, enabling remote collaboration and data-driven decision-making.

Additionally, these tools facilitate the creation of customized reports for sharing with boards or congregants. Automation is especially helpful for smaller churches with limited staff and volunteers.

-

Share Financial Reports Openly

Provide quarterly reports to boards and annual summaries to congregants. Include income, expenses, and ministry impact—especially stories and testimonials that illustrate how funds have made a difference in the church, the congregation and the community. Note: Be sure to customize reports to protect donor confidentiality.

-

Create a Financial Policy Document

To establish and maintain boundaries, document procedures for budgeting, spending, and approvals. Define roles and conflict-of-interest policies to ensure clarity and continuity. Also, ensure that staff and volunteers are familiar with the document.

6. Encourage Open Financial Meetings

Host forums where members can ask questions and review reports, especially when considering large expenditures. Transparency fosters shared responsibility and strengthens trust within the church and the community.

7. Be Realistic About Project Affordability

Ministry requires funding, but churches should avoid overextending their finances. Evaluate major expenditures against current resources and long-term sustainability. Balance present needs with future plans. Churches must assess their financial health realistically, especially considering changing attendance and giving patterns.

8. Train Staff and Trustees

Provide compliance training for everyone involved in managing church finances. For roles involving budgeting, payroll and accounting, select staff and volunteers who possess financial backgrounds and experience. Moreover, trustees should be equipped with skills in budgeting, legal matters and property management, complemented by spiritual maturity.

They should receive regular fiscal training to stay informed about nonprofit governance, compensation structures, clergy tax issues and risk management.

9. Align Budgeting with Ministry Goals

Use budgeting methods that reflect your church’s mission, and consider one of the following approaches:

-

- Incremental Budgeting: Adjusts last year’s budget based on expected changes.

- Zero-Based Budgeting: Builds each line item from scratch.

- Program Budgeting: Evaluates ministries based on effectiveness and funding needs.

Whichever method you choose, prioritize outreach and ministries with the greatest impact while balancing current and future needs.

10. Build a Stewardship-Focused Finance Committee

Form a stewardship committee that includes the pastor, treasurer, and trustees. This group should review current financial performance, collect ministry budget requests, and propose a transparent budget that reflects the church’s values.

Summing It All Up

Transparency is not just a financial practice—it’s a spiritual commitment. By embracing these strategies, churches can fulfill their sacred imperative while building trust and deepening engagement in their ministries.

Next

Next