Are We There Yet? Measuring Your Progress on the Journey to Retirement - Part 2

Will you be financially ready for retirement? You can employ some simple measures to help you check your financial health and take regular steps to improve it.

In part one of this two-part series, we shared two simple ratios or percentages based on your income. In part two of the series, let’s take a look at the third of the ratios and how to put all three measures together to view a fuller picture of your financial health. We’ll use the fictional Jones family to illustrate.

Debt to Income

The final measure is not often thought of as a measure for retirement, but because debt has a negative impact both on how much you can save now and how much income you will need in the future, it is an important measure of your financial health. Every dollar you pay monthly toward debt is a dollar that you are not putting toward retirement (or worse yet, must spend in retirement).

Calculate the Ratio

- Add up the total current balance on all your debts (credit cards, student loans, mortgage, auto, etc.)

- Add up your annual gross income.

Divide our total debt by your total income.

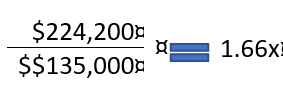

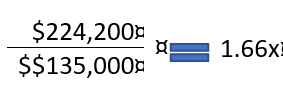

The Jones family has total debt of $224,200

- a home mortgage of $210,000

- an auto loan of $9,500

- credit card balances of $4,700

- Annual Income of $135,000

The Jones’ have total debt equal to 1.66 times their total annual income.

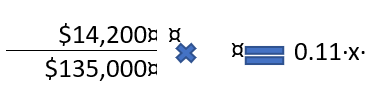

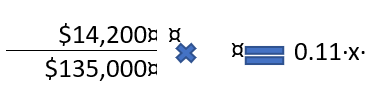

Because not all debt is the same: You may want to do this calculation a second time and exclude mortgage debt, since that is long-term debt in an asset that will hopefully appreciate (like an investment).

For the Jones’ then, the result without their mortgage would be:

These calculations are for illustrative purposes only.

It is a worthy goal to enter retirement with as little debt as possible, with the possible exception of a mortgage. Eliminating retirement debt reduces the amount of income you need in retirement (our first ratio) and thus the amount you must save during your working years (our second ratio).

Putting It All Together

If you take the time to calculate these three ratios you have not really answered the question, “Are we there yet?” But you do have a measure of where you are today, and more importantly a way of measuring your progress over time. Take a look at your numbers. Are they where you would like them to be? If not, then come up with one or two changes you can make to your financial life that would move those numbers in a positive direction.

- If your Retirement Income to Assets ratio is low, take a look at your Savings to Income ratio. What can you do to save just a bit more each month? Drop an entertainment subscription? Eat out less? Adjust the thermostat a couple degrees?

- If your debt ratio is high, start by evaluating whether your overall debt is increasing monthly. If it is, evaluate your spending patterns and see what you can eliminate (as in the previous example) that is adding to your debt. If your debt ratio is stable and you are paying down your debt every month, consider adding a bit of extra money every month to paying off either the smallest debt (referred to as the snowball method) or to the debt with the highest interest rate (referred to as the avalanche method).

Once you have decided on the changes that you want to make in your financial life, let the changes take effect. There is no need to calculate these ratios every month; instead, do this as part of an annual checkup and goal setting. Some people do it in January after they get year-end statements. Others do it at the same time they do their taxes since the documentation is readily at hand. The key is not to focus on what your current number is, but on the behaviors you want to change. What you want to see is numbers next year that are better than this year, a sign that you are moving toward your goal.

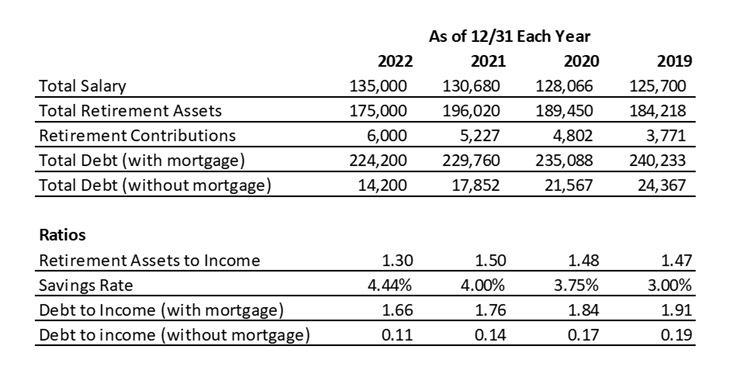

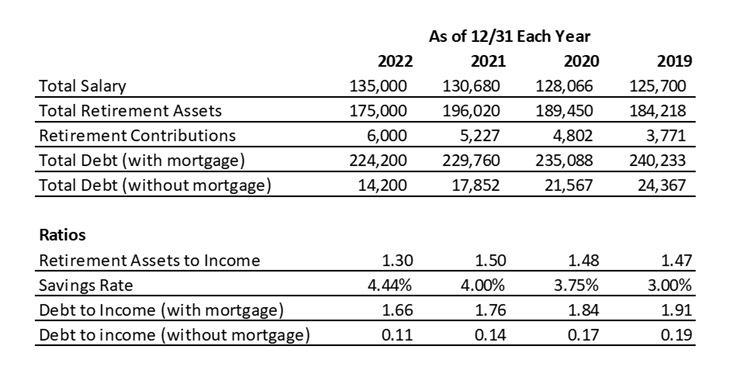

Here is an illustration of the work the Jones family has been doing in their financial life for the last 4 years:

These calculations are for illustrative purposes only.

The Jones family is making steady progress, and that is how you can reach your goal too!

Next

Next