Are We There Yet? Measuring Your Progress on the Journey to Retirement - Part 1

Financial planners often hear from our clients a version of the refrain of many a bored child on a car ride: “Are we there yet?” The individuals we work with want to know if they have saved enough to be able to retire, or how much they should be saving along their journey. Those are important questions and having a way to measure your progress is helpful so you can make adjustments and end up ready to retire.

Short-term goals are relatively easy to manage; if you are starting with zero and need $1,200 in a year for the down payment on a car, you will need to save roughly $100 a month (not counting any investment return you might expect). Saving for longer term goals like retirement is more difficult because it is not always easy to know an exact target dollar amount. Do you need $500,000 saved to retire, or double, or triple that amount? Calculating what you need is beyond the scope of this article, because the answer is personalized for each family. But that doesn’t mean we cannot employ some simple measures to help you check your financial health and take regular steps to improve it.

Not many of us want to be dependent on a paycheck for our whole lives, so we will focus on some simple measurements you can use to measure your progress. The measurements we are going to use are simple ratios or percentages. All of them are based on your income. Why your income? Because planning for retirement at its most basic level is about accumulating retirement assets that will replace your income. In the first of a two-part series, let’s take a look at the first two of the ratios and use the fictional Jones family to illustrate.

Three Key Ratios

Retirement Assets to Income

The primary goal of investing for retirement is to create financial resources that will replace the income that you earn from working. The question is how much do you need? Financial planners and financial planning publications use a range of numbers, generally suggesting that you need to accumulate in retirement savings somewhere between 10 and 15 times your final annual salary. If you anticipate your final salary to be $50,000 that would be somewhere between $500,000 and $750,000. If you are closer to retirement and want to be more precise, what you really want to know is what your anticipated annual expenses are going to be. If at retirement you have a final salary that is significantly more than what you anticipate you will need on an annual basis, you may be able to target a lower multiple of your final salary. On the other hand, regardless of how much you make, if you are spending most of what you make (excluding what you are saving monthly for retirement) you will likely need to aim for a higher multiple of your salary to save.

Calculating the Ratio

You will need:

- The value of your assets and investments that you have already saved for retirement. Don’t use your total net worth or the value of assets that you will not use to support yourself in retirement.

- Your current gross salary (include your spouse’s if married).

Now divide the value of your assets by your current annual salary.

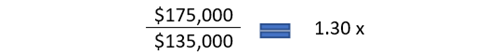

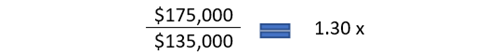

- The Jones family has retirement savings in IRAs, an MMBB account and an employer 401k account of $175,000.

- Together, the Jones’ combined income is $135,000 a year.

These calculations are for illustrative purposes only.

At this point, the Jones’ have saved an amount equal to 1.3 times their annual income (or 1.3 years’ worth of current income).

Savings Rate to Income

During your working years it can be helpful to think about splitting your paycheck into two parts:

- Funding your current lifestyle

- Funding your future retirement lifestyle.

The way most of us have accumulated assets to support our future retirement is by saving some of our current income. Again, the obvious question is, how much should I be saving? The value of a dollar saved in the future is partially determined by how long that dollar is invested. The younger you are when you start saving, the less you have to save, at least in comparison with someone older and closer in age to retirement. But generally, financial planners suggest a target savings rate in the range of 10% to 15%, but if you are starting late you may need to be more aggressive.

Calculate the Rate

You will need:

- Your total monthly contributions you make to your retirement plans (403b, IRA, 401k, etc.), include your spouse’s contributions if married.

- Your total gross monthly salary.

Divide your total contributions by your gross salary, then multiply the result by 100.

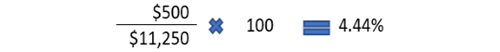

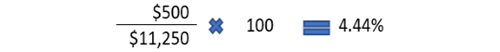

- The Jones family saves $500 a month between their two paychecks.

- Their combined gross monthly salary is $11,250.

These calculations are for illustrative purposes only.

The Jones’ have a savings rate of 4.44%

You now know the first two ways to measure your progress on your road to retirement. Watch for part two of this article next month for details about the third ratio and how to put all three ratios together for a fuller picture of your retirement readiness.

Next

Next