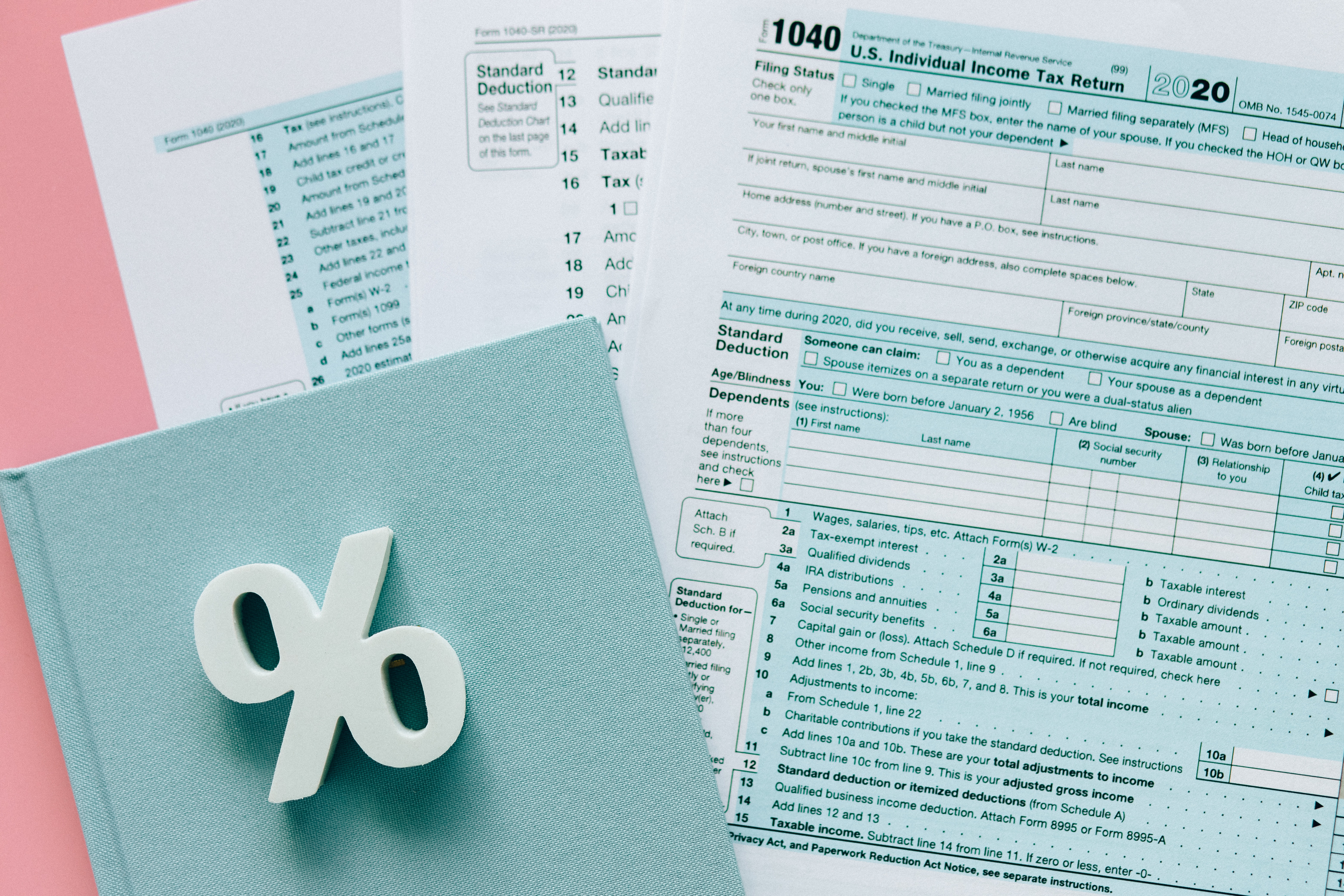

For the tax year 2022, the standard deduction for married couples filing jointly rises to $25,900 up $800 from the amount in 2021. For single taxpayers and married individuals filing separately, the standard deduction rises to $12,950 for 2022, up $400, and for heads of households, the standard deduction will be $19,400 for tax year 2022, up $600. Just a reminder that this change will apply to tax returns filed in 2023.

The standard tax deduction is a specific dollar amount that reduces your taxable income. Each year you have a choice of claiming the standard deduction or claiming itemized deductions when completing your federal income tax return. If you have no other qualifying deductions or tax credits, the Internal Revenue Service lets you take the standard deduction with no questions asked.

If you have questions regarding the standard tax deduction, the MMBB Financial Planning Specialists may be able to help.

Next

Next

Next

Next