The Markets (as of market close November 30, 2022)

A late rally at the end of the month helped push stocks higher in November, marking the second monthly advance in a row. Each of the benchmark indexes posted solid monthly gains, led by the Global Dow, which advanced nearly 11.0%. The large caps of the S&P 500 and the Dow rose more than 5.0%. The Nasdaq climbed 4.4%, while the Russell 2000 added 2.2%.

Investors welcomed news from Federal Reserve Chair Jerome Powell, who announced that the pace of interest-rate hikes can slow as soon as December, which likely means a 50-basis point increase, ending the string of 75-basis point rate hikes. The Fed may be taking note of the fact that the labor market has begun to cool (see the employment report below), while consumer price increases are showing signs of moderation. Nevertheless, prices remain elevated entering the holiday shopping season. However, business conditions remained generally positive, and consumers continued to spend, despite rising interest rates and decreasing levels of confidence (see report below).

Despite the relative good news from the Federal Reserve, Wall Street faced the ramifications of political unrest in China over that nation's COVID-related restrictions. The issues in China are likely to have a negative impact on the global economy, particularly the U.S. economy, as China is a main source of the global supply-chain system, which is still trying to recover from the pandemic.

A drop in U.S. crude supplies boosted crude oil prices at the end of November. Nevertheless, prices ended the month lower for the fifth loss in the last six months. China's COVID restrictions impacted the demand for crude oil, helping to keep prices muted. Prices at the pump declined in November. The national average retail price for regular gasoline was $3.534 per gallon on November 28, down from $3.742 on October 31 but $0.154 higher than a year ago.

Bond prices rose in November, pulling yields lower. Ten-year Treasury yields fell 37 basis points. The Treasury yield curve, often seen as a warning sign of an impending recession, recorded its steepest inversion in over 40 years as the 10-year Treasury yield dropped 0.78 percentage point below the two-year yield. The dollar slid lower against a basket of world currencies. Gold prices rose 9.0% in November, ending a streak of seven consecutive monthly declines.

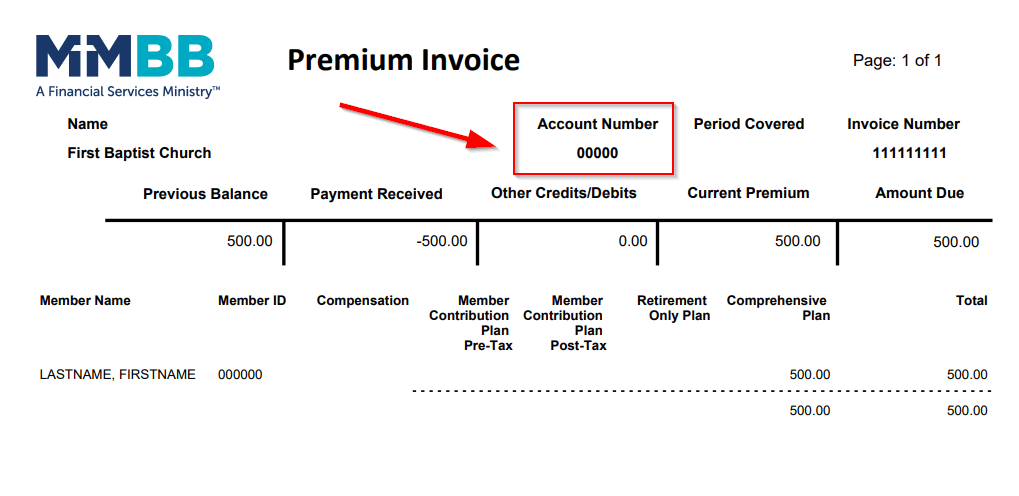

MARKET SUMMARY

| MARKET/INDEX |

2021 CLOSE |

PRIOR MONTH |

AS OF 11/30 |

MONTHLY CHANGE |

YTD CHANGE |

| DJIA |

36,338.30 |

32,732.95 |

34,589.77 |

5.67% |

-4.81% |

| NASDAQ |

15,644.97 |

10,988.15 |

11,468.00 |

4.37% |

-26.70% |

| S&P 500 |

4,766.18 |

3,871.98 |

4,080.11 |

5.38% |

-14.39% |

| RUSSELL 2000 |

2,245.31 |

1,846.86 |

1,886.58 |

2.15% |

-15.98% |

| GLOBAL DOW |

4,137.63 |

3,432.62 |

3,782.87 |

10.20% |

-8.57% |

| FED. FUNDS |

0.00%-0.25% |

3.00%-3.25% |

3.75%-4.00% |

75 bps |

375 bps |

| 10-YEAR TREASURIES |

1.51% |

4.07% |

3.70% |

-37 bps |

219 bps |

| US DOLLAR-DXY |

95.64 |

111.58 |

106.03 |

-4.97% |

10.86% |

| CRUDE OIL-CL=F |

$75.44 |

$86.10 |

$80.41 |

-6.61% |

6.59% |

| GOLD-GC=F |

$1,830.30 |

$1,635.70 |

$1,783.00 |

9.01% |

-2.58% |

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Latest Economic Reports

- Employment: Employment rose by 261,000 in October after increasing by 263,000 in September. Monthly job growth has averaged 407,000 thus far in 2022 compared with 562,000 in 2021. In October, notable job gains occurred in health care, professional and technical services, and manufacturing. The unemployment rate increased by 0.2 percentage point to 3.7% in October, and the number of unemployed persons rose by 306,000 to 1 million. The unemployment rate has been in a narrow range of 3.5% to 3.7% since March. Among the unemployed, the number of workers who permanently lost their jobs remained at about 1.2 million in October. The labor force participation rate, at 62.2%, and the employment-population ratio, at 60.0%, were unchanged in October and have shown little net change since early this year. In October, average hourly earnings rose by $0.12, or 0.4%, to $32.58. Over the 12 months ended in October, average hourly earnings increased by 4.7% (5.0% for the 12 months ended in September). In October, the average work week was 34.5 hours for the fifth month in a row.

- There were 225,000 initial claims for unemployment insurance for the week ended November 26, while the total number of insured unemployment claims was 1,608,000 as of November A year ago, there were 240,000 initial claims for unemployment insurance and 1,976,000 total insured unemployment claims.

- FOMC/interest rates: As expected, the Federal Open Market Committee increased the federal funds target rate range in November by 75 basis points to 3.75%-4.00%. Inflationary pressures have begun to show some signs of waning. The FOMC noted that "In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments." As such, while interest-rate hikes may not pause, the amount of each increase may lessen from the string of 75-basis point hikes.

- GDP/budget: Gross domestic product increased 2.9% in the third quarter, according to the second estimate released by the Bureau of Economic Analysis. The third-quarter increase follows decreases in the first quarter (-1.6%) and the second quarter (-0.6%). The increase in GDP reflected advances in exports; consumer spending; nonresidential (business) fixed investment; and federal, state, and local government spending that were partly offset by decreases in residential fixed investment and private inventory investment. Imports, which are a subtraction in the calculation of GDP, decreased. Consumer spending rose 7% in the third quarter after increasing 2.0% in the second quarter. Most of the increase in consumer spending was attributable to a 2.7% jump in services, while spending on durables slid 0.3%. Also dragging down GDP was a 4.1% decline in fixed investment, within which residential fixed investment dropped 26.8%, evidence of the slowdown in the housing sector. Nonresidential fixed investment jumped 5.1% in the third quarter after inching up 0.1% in the previous quarter. Exports rose 15.3% in the third quarter, while imports fell 7.3% after increasing 2.2% in the second quarter. The personal consumption expenditures price index, a measure of inflation, increased 4.3% in the third quarter following a 7.3% rise in the second quarter.

- For October, the first month of fiscal year 2023, the Treasury budget deficit came in at $87.8 billion, down from $429.7 billion in September and under the October 2021 deficit of $165.1 billion. Compared to September, government receipts in October were $318.6 billion, a decrease of $169.1 billion, while government expenditures were $406.4 billion, $511.1 billion less than in September.

- Inflation/consumer spending: Overall, while inflationary pressures continued to advance in October, there are signs that price increases are easing. The personal consumption expenditures price index, a preferred inflation indicator of the Federal Reserve, advanced 0.3% in October, the same increase as in September. For the year ended in October, prices have increased 6.0%. Prices less food and energy increased 0.2% in October and 5.0% since October 2021. Prices for durable goods fell 0.6% in October, while prices for nondurable goods rose 0.8%. Prices for services rose 0.4% in October. Food prices increased 0.4%, while energy prices advanced 2.5%. Consumer spending increased 0.8% in October. Spending on goods increased 1.1%, while consumer spending on services advanced 0.2%. Personal income and disposable (after-tax) personal income rose 0.7% in October. Wages and salaries increased 0.5% in October after advancing 0.6% in September.

- The Consumer Price Index rose 0.4% in October, the same increase as in September. For the 12 months ended in October, the CPI increased 7.7% (8.2% for the 12-month period ended in September). Both the monthly and 12-month increases were below expectations. In October, the CPI less food and energy rose 3%, down from the September increase of 0.6%. For the 12 months ended in October, the CPI less food and energy rose 6.3% (6.6% since September 2021). Prices for shelter (0.8%) contributed over half of the overall CPI increase in October, with prices for gasoline and food also moving higher. In October, prices for used cars and trucks declined 2.4%, prices for apparel slid 0.7%, and prices for medical services decreased 0.6%. For the 12 months ended in October, food prices increased 10.9%, energy prices rose 17.6% (fuel oil prices increased 68.5%), prices for shelter advanced 6.9%, and prices for transportation services rose 15.2%.

- Producer prices for goods and services rose 0.2% in October following a 0.4% increase in September. Producer prices increased 8.0% since October 2021 (8.5% for the 12 months ended in September). Prices less foods, energy, and trade services increased 2% in October and 5.4% since October 2021. October producer prices for goods moved up 0.6%, while prices for services slid 0.1%, the first decline since November 2020.

- Housing: Sales of existing homes retreated for the ninth consecutive month in October, falling 5.9% from the September estimate. Year over year, existing home sales were 28.4% under the October 2021 total. According to the latest survey from the National Association of Realtors®, rising mortgage rates and dwindling inventory have impacted sales. The median existing-home price was $379,100 in October, down from $383,500 in September but 6.6% higher than in October 2021 ($355,700). In October, unsold inventory of existing homes represented a 3.1-month supply at the current sales pace, down 0.8% from both September 2022 and October 2021. Sales of existing single-family homes fell 6.4% in October and 28.2% since October 2021. The median existing single-family home price was $384,900 in October, down from $389,600 in September but 6.2% over the October 2021 price.

- Sales of new single-family homes reversed course, climbing 7.5% in October after declining 10.9% in September. Sales are down 5.8% since October 2021. The jump in new home sales may be partly attributable to purchasers using prequalified mortgages that were locked in at a lower interest rate. Inventory sat at an 8.9-month supply in October (9.4 months in September). The median sales price of new single-family houses sold in October was $493,000 ($455,700 in September). The October average sales price was $544,000 ($516,400 in September).

- Manufacturing: Industrial production decreased 0.1% in October after inching up 0.1% (revised) in September. While manufacturing output rose 0.1%, the indexes for both mining (-0.4%) and utilities (-1.5%) declined in October. The decline in mining was attributable to a drop in oil and gas extraction, which outweighed improvements in oil and gas well drilling and in coal mining. The decline in utilities reflected a decrease in electric utilities, which more than offset an increase in natural gas utilities. Overall, industrial production was up 3.3% since October 2021. The major market groups recorded mixed results in October. Gains were registered by consumer goods, business equipment, and defense and space equipment, while losses were posted by construction supplies and materials.

- October saw new orders for durable goods beat expectations after increasing 1.0%. The October increase followed a 0.3% jump in durable goods orders in September. Excluding transportation, new orders rose 0.5% in October. Excluding defense, new orders increased 0.8%. Transportation equipment drove the October increase, climbing 2.1%. New orders for capital goods jumped 1.9% in October after increasing 0.4% the previous month.

- Imports and exports: Import and export prices declined in October, indicating inflationary pressures may be easing. According to the U.S. Bureau of Labor Statistics, import prices slid 0.2% in October after falling 1.1% the previous month. Export prices dipped 0.3% in October after declining 1.5% in September. Import prices have not recorded a monthly increase since June 2022. Despite recent declines, import prices are up 4.2% since October 2021, the smallest yearly advance since the 12 months ended February 2021. With the October decline, export prices have fallen in each of the last four months, reflecting weakness in global demand. Export prices have increased 6.9% since October 2021.

- The international trade in goods deficit was $99.0 billion in October, up 7.7% from September. Exports of goods fell 2.6% in October following a 1.9% decline in September. Imports of goods rose 0.9% in October after increasing 1.0% in September. Year to date, exports rose 10.7%, while imports increased 12.6%.

- The latest information on international trade in goods and services, released November 3, is for September and shows that the goods and services trade deficit increased by 11.6% from the August deficit. September exports slid 1.1%, while imports increased 1.5%. Year over year, the goods and services deficit increased 20.2% from the same period in 2021. Both exports and imports increased 20,2% since October 2021.

- International markets: Inflationary pressures have been soaring in Japan. Consumer prices rose in October for the 14th consecutive month, and have risen 3.7% over the last 12 months. Higher producer and import costs have been passed on to consumers, hiking prices for food, beverages, electronic appliances, and other consumer products and services. The government of the United Kingdom, in an effort to combat rising prices, indicated it would significantly tighten its fiscal policy after projecting a 9.1% inflation rate for this year. Despite that prediction, the annual rate of inflation in the eurozone fell in November for the first time since June 2021. However, the lag in inflation isn't likely to curtail the European Central Bank from increasing interest rates further. The economy in China contracted in November as weakening economic output resulted from government-led lockdowns due to rising COVID cases. Overall for the markets in November, the STOXX Europe 600 Index rose 6.5%. The United Kingdom's FTSE advanced roughly 6.2%. Japan's Nikkei 225 Index advanced 1.1%, while China's Shanghai Composite Index climbed 4.9%.

- Consumer confidence: The Conference Board Consumer Confidence Index® decreased in November for the second consecutive month. The November index stands at 100.2, down from 102.2 in October. The Present Situation Index, based on consumers' assessment of current business and labor market conditions, declined to 137.4 in November, down from 138.7 in October. The Expectations Index, based on consumers' short-term outlook for income, business, and labor market conditions, fell to 75.4 in November (77.9 in October).

Eye on the Month Ahead

Rising inflation, and the government's response to it, continued to influence the market in November. The Federal Open Market Committee increased the federal funds rate by 75 basis points in November for the fourth time this year. However, indications are that the Committee may scale back interest-rate hikes beginning in December. Oversupply and waning demand drove crude oil prices lower in November. Nevertheless, prices are expected to rise again in December as the cold weather should increase demand. As to the stock market, December is usually a good month for equities, which should make for a solid fourth quarter.

Data sources: Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI, Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates). News items are based on reports from multiple commonly available international news sources (i.e., wire services) and are independently verified when necessary with secondary sources such as government agencies, corporate press releases, or trade organizations. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Forecasts are based on current conditions, subject to change, and may not come to pass. U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. The principal value of Treasury securities and other bonds fluctuates with market conditions. Bonds are subject to inflation, interest-rate, and credit risks. As interest rates rise, bond prices typically fall. A bond sold or redeemed prior to maturity may be subject to loss. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 largest, publicly traded companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange. The Russell 2000 is a market-cap weighted index composed of 2,000 U.S. small-cap common stocks. The Global Dow is an equally weighted index of 150 widely traded blue-chip common stocks worldwide. The U.S. Dollar Index is a geometrically weighted index of the value of the U.S. dollar relative to six foreign currencies. Market indexes listed are unmanaged and are not available for direct investment.

IMPORTANT DISCLOSURES

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.