Managing Multiple Financial Priorities - Part 2

Throughout this three-part series on managing multiple financial priorities, we will offer insight on valuable steps for tackling your financial goals. In this article, we will analyze your categorized list created in part one of the series to help you determine where and how much to invest, and how to save for your competing financial goals.

While reviewing how you categorized your financial goals, i.e., required, lifestyle or aspirational, and the numerical order assigned to each, keep in mind you might need some assistance prioritizing. As a reminder:

- Required expenses you are committed to and that you must pay for.

- Lifestyle are discretionary expenses that you choose to spend money on now.

- Aspirational (Goals) are things you would like to have but need to save for in order to achieve them.

Doing the right thing when it comes to monitoring your spending is not always easy. To some, going on an extravagant vacation once a year might be a priority, but if you have a mortgage and/or car payment, that expensive island-hopping adventure might need to take a back seat. You may equate this to making a choice between immediate gratification for a short time versus what is best for you in the long-term. To sustain your lifestyle and stay on track with your financial goals, it’s best not make rash decisions but instead think of your finances over the long-term. When it comes to lifestyle spending, you will almost always want more than you can afford so having discipline is key.

Keep that fact in mind as you numerically order your list based on priorities; this list should be fluid and adjustable.

After you’ve prepared an ordered list, it is time to determine your sources of income to support your goals:

- What is your available income?

- Review your after-tax income using your most recent pay stubs or bank statements to determine your average monthly income available to spend.

- What is your required monthly spending?

- Using recent bills or bank/credit card statements, total your required monthly expenses, and include an equivalent monthly amount for required expenses that are paid less frequently, like insurance or property tax payments. If you pay your property taxes in two installments a year, divide one installment by 6 and use that as a monthly figure.

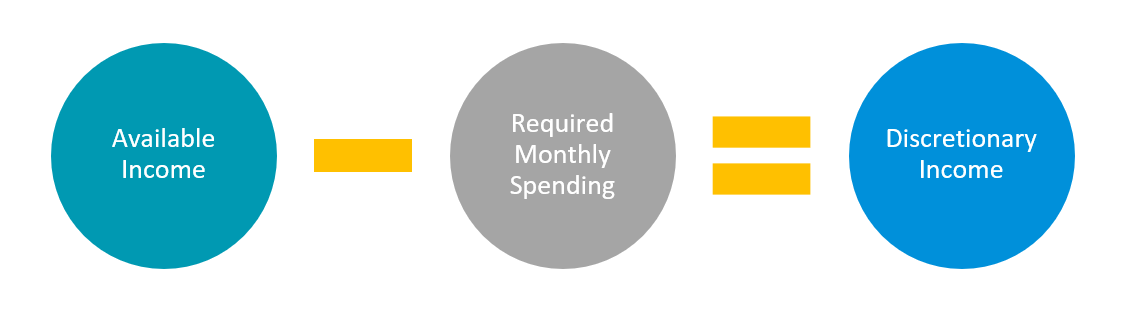

- What do you have left?

- Calculate Discretionary Income: Subtract your required monthly spending amount from your available income and that equates to your discretionary income. Your discretionary income can be allocated between your current lifestyle spending and your aspirational spending/goals.

Based on your discretionary income, refer to your two remaining lists: lifestyle and aspirational.

Allocate estimated dollar amounts toward each of your remaining goals.

Review these two lists, starting with the Lifestyle list.

For Lifestyle spending: Assign a monthly value to each, either based on your actual spending or a target amount. Total up these expenses.

For Aspirational (Goals) Savings: Assign the total amount you need to achieve the goal and the target date when you would like to achieve the goal. For some goals like retirement, it is probably helpful to break the target amount you want to achieve by time periods. For example, determine how much you want to save by age 30, 40, or 50. The same example can apply to saving for a house by aiming for a certain objective after one year, two years or three years.

Does the total exceed your discretionary income that you calculated? If so, you have not left yourself any money to apply to your goals. Evaluate your list and determine where you can either eliminate or reduce any expenses to apply toward your goals.

We understand that these choices are personal; only you can decide how much to prioritize current spending over saving for your goals. Once you have some discretionary income available to apply to your aspirational spending, allocate a monthly amount to your goals based on how you prioritized them. Keep in mind you may not be able to save toward every goal.

Be sure to make goals that will support your long-term financial health, like retirement and creating an emergency fund, a priority. And remember, saving consistently begins with understanding how you are spending your money.

Watch for part three of our series on managing multiple priorities in the December issue of Tomorrow.

The information contained herein is for informational purposes only. While MMBB made every attempt to ensure that the information is accurate, MMBB is not responsible for any errors or omissions or the results obtained from the use of this information. MMBB is not liable for any success or failure that is directly or indirectly related to the use of the information contained herein. The information contained herein does not constitute any financial, insurance, investment, legal, or tax advice. In no event shall, MMBB and/or its fiduciaries, directors, officers, employees, or agents thereof be liable for any special, direct, indirect, consequential, or incidental damages or any damages whatsoever, whether in action of contract, negligence or tort, arising out of or in connection with the use of the information contained herein.

Next

Next