Featured Article

While many retired clergy choose to enjoy their well-deserved season of rest, some seek ways to continue nurturing their spiritual calling.

A financial planner can provide guidance on everything from budgeting to insurance to estate planning and is required to act in your best interest.

You provide your personal and financial data and your financial planner will use this information to work with you on a financial plan that shows how and when you can expect to accomplish your goals.

Your plan can address a variety of financial concerns from insurance needs to education funding and estate planning to debt management. It can include information about how much you need to save and how much you will earn and spend and recommend what types of retirement investments to use to achieve your goals.

Our financial planners follow the CFP Board enhanced standards for the financial planning process listed below:

Understanding

your personal

and financial

circumstances

Identifying and

selecting goals

Analyzing your

current course

of action and

potential

alternative

courses of action

Developing the

financial

planning

recommendation(s)

Presenting the

financial

planning

recommendation(s)

Implementing the financial planning recommendation(s)

Monitoring

the progress

and updating

All financial planners at MMBB carry the CFP® certification, one of the most respected certifications that a financial planner can attain. This indicates the planner has undergone rigorous study and met stringent examination and ethics requirements. Additionally, our financial planners are fiduciaries, which means they always act in the best interests of their clients.

"CFP Board owns the marks CFP®, CERTIFIED FINANCIAL PLANNERTM, and CFP® (with plaque design) in the U.S."

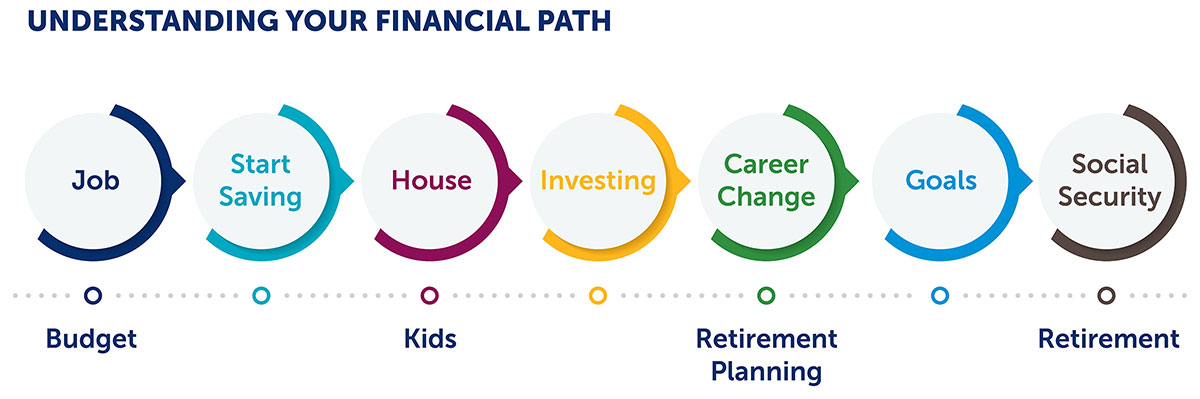

Connect with a Financial PlannerNo matter what stage of life you find yourself in, it’s important to remain focused on your long-term financial objectives.

It’s possible that these goals will change over time. For instance, you’ve just had a baby and want to start saving for their education or you’ve just changed jobs and want to make sure you’re still on the right path to save for retirement. Perhaps you’re nearing retirement and are concerned that your Social Security benefits won’t be enough to sustain you and your family. Our financial planners are happy to guide you through each stage of your financial journey.

Thank you for joining the MMBB mailing list. You will begin to receive information soon.

Translations of any materials into languages other than English are intended solely as a convenience to the non-English-reading public. We have attempted to provide an accurate translation of the original material in English, but due to the nuances in translating to a foreign language, slight differences may exist.

Las traducciones de cualquier material a idiomas que no sean el inglés son para la conveniencia de aquellos que no leen inglés. Hemos intentado proporcionar una traducción precisa del material original en inglés, pero debido a las diferencias de la traducción a un idioma extranjero, pueden existir ligeras diferencias.

MMBB Financial Services is pleased to unveil our new website experience.

Watch a guided tutorial of our enhanced site to introduce you to important new features designed to help you live your life with financial confidence.

You will be linking to another website not owned or operated by MMBB. MMBB is not responsible for the availability or content of this website and does not represent either the linked website or you, should you enter into a transaction. The inclusion of any hyperlink does not imply any endorsement, investigation, verification or monitoring by MMBB of any information in any hyperlinked site. We encourage you to review their privacy and security policies which may differ from MMBB.

If you “Proceed”, the link will open in a new window.

Back to Top

Back to Top